AI vs Crypto Clash: What it Means for Energy and Infrastructure

It feels like everywhere you look, there’s talk about AI. And then there’s crypto mining, which has been around for a while. Both demand massive computing power—but they use it in very different ways. AI chews through data to train models and run applications, while crypto mining solves mathematical puzzles to secure blockchains and mint new coins.

This growing overlap has sparked an AI vs Crypto moment. Many companies that once focused solely on Bitcoin mining are now rethinking their business models, asking whether their racks of GPUs and energy contracts could earn more profit running AI workloads instead of hashing blocks.

It’s a big shift that’s reshaping how we think about data centers, energy infrastructure, and the economics of computation itself. We’re going to look at how these two worlds—AI and crypto—are bumping up against each other, especially when it comes to just how much power they consume and where our electricity ends up flowing.

Key Takeaways

- Many Bitcoin mining companies are looking into AI to make more money because mining itself isn’t as profitable as it used to be, especially after the Bitcoin halving.

- Companies are finding they can use their existing mining setups, like data centers and power infrastructure, to support AI tasks, sometimes by adding new equipment like GPUs.

- Both AI and crypto mining use a lot of electricity, which puts pressure on power grids and can lead to higher energy costs for everyone.

- There’s a growing competition for resources like power and equipment between AI firms and crypto miners, forcing companies to make smart choices about where to invest.

- The future might see AI and crypto mining working together in some ways, or competing more directly, depending on how technology and energy markets develop.

The Shifting Landscape of Computing Power

The way we use computing power is changing, and fast. For a while now, crypto mining has been a big user of processing power, but something new is really taking over: AI. Think about it, AI models are getting super complex, needing way more horsepower than ever before. This shift means the whole game for computing resources is changing.

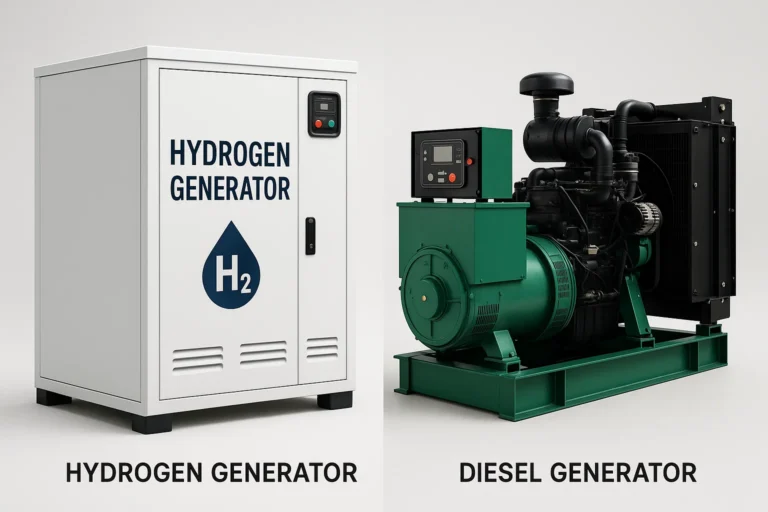

AI Computing Versus Crypto Mining

It’s not quite apples and oranges, but AI computing and crypto mining definitely have different needs. AI tasks, like training a big language model, need processors that can handle lots of different, complex calculations quickly. They often rely on GPUs, which are great for parallel processing. Crypto mining, on the other hand, is usually about doing the same calculation over and over, really fast. This is where ASICs, or specialized chips, often come in, though GPUs are still used for some coins.

- AI Computing: Needs flexibility, high bandwidth, and low delays for tasks like real-time analysis and continuous learning.

- Crypto Mining: Focuses on raw, repetitive computational power for tasks like securing blockchains.

Evolution of Demand for Computing Resources

Just a few years ago, cloud computing and data analysis were the big drivers of computing demand. Now, AI is the main event. We’re talking about models like ChatGPT and others that require massive amounts of processing. The market for AI is booming, projected to hit over a trillion dollars by 2030. This growth means a huge increase in the need for specialized hardware and data center capacity.

The demand for computing power is growing fast, driven by AI and crypto mining. AI needs advanced hardware for complex tasks, while mining focuses on repetitive calculations. This evolution is reshaping the entire tech infrastructure landscape.

Market Dynamics and Technological Advancements

Because of this shift, many crypto mining companies are looking at AI as a way to diversify. Their existing facilities, which are built for high power consumption and cooling, can be adapted for AI workloads. Some companies are even looking at hybrid models, where they can switch between mining and AI tasks depending on what’s more profitable or in demand. This flexibility is key to staying competitive. It’s all about finding sustainable computing solutions that can adapt to these changing needs. The infrastructure requirements are different, though; AI often needs more robust cooling and power management than basic mining setups. This means upgrades are often necessary for companies making the switch.

Strategic Diversification for Mining Companies

It’s becoming pretty clear that just mining Bitcoin might not be enough for a lot of these companies anymore. The market shifts, and you’ve got to adapt, right? Many mining outfits are sitting on a ton of computing power and, more importantly, access to massive amounts of electricity. This is exactly what the AI world is hungry for. So, it makes sense that they’re looking at how to use what they already have for something new.

Leveraging Existing Infrastructure for AI

Think about it: these mining operations have data centers, cooling systems, and, crucially, power contracts. These are the building blocks for AI. Instead of just running ASICs for Bitcoin, they can outfit these same spaces with GPUs, the workhorses for AI tasks. It’s like having a factory that makes one thing, but realizing you can retool it to make something else that’s in high demand. Companies are already exploring this, looking at how to convert parts of their facilities. It’s not a simple flip of a switch, though. You need the right hardware, and you need clients who want to rent that space and power for their AI projects.

Hybrid Models Combining Mining and AI

This is where things get really interesting. Instead of ditching mining altogether, many are looking at a mixed approach. They keep mining Bitcoin, which is their bread and butter, but they also rent out their GPU capacity to AI companies. This creates a dual revenue stream. For example, Hive Digital Technologies has put a lot of money into GPU clusters and is seeing its AI hosting revenue grow significantly. Iris Energy is doing something similar, scaling up its GPUs and offering AI cloud services alongside its mining. It’s a way to spread the risk and potentially boost profits.

Here’s a look at how some are balancing both:

- Hive Digital Technologies: Invested heavily in GPUs, aiming for $100 million in AI revenue by 2026.

- Iris Energy: Scaled up GPU operations and is building AI-focused data centers.

- Riot Platforms: Assessing conversion of significant power capacity for high-performance computing.

- MARA Holdings: Focusing on edge computing and developing cooling systems for intensive AI tasks.

The key here is that the underlying infrastructure – the power, the space, the cooling – is already there. It’s about finding smart ways to utilize it for multiple purposes, rather than letting it sit idle or only serve one function. This makes the whole operation more resilient.

Case Studies of Mining Companies Entering AI

We’re seeing real examples of this shift. Riot Platforms, for instance, is looking at converting a huge chunk of its power capacity in Texas for AI. They’ve got the land and the power hookups, which is a big deal when building new AI data centers can take years just to get connected to the grid. MARA Holdings is also exploring AI, particularly with its immersion cooling systems designed for heavy computing. While these moves are still in the early stages for many, the potential is huge.

Some analysts suggest that repurposing mining facilities for AI could make them up to five times more valuable. It’s a smart move to diversify, especially when you consider the volatility of crypto markets and the booming demand for AI compute power. Companies that can successfully integrate AI services might find themselves in a much stronger position, potentially attracting clients like Amazon or Google who need massive computing resources. It’s a calculated risk, but one that could pay off big time, especially if they can secure stable power agreements, perhaps from sources like those offered by clean energy providers.

The Growing Demand for AI Infrastructure

AI’s Need for High-Performance Computing

Artificial intelligence, especially the kind that learns and creates, needs a serious amount of computing muscle. Think about training a big AI model; it’s like asking a super-smart student to read every book ever written and then write a new one. This process requires massive parallel processing, which is where specialized hardware comes in. The sheer scale of AI processing power usage is unlike anything we’ve seen before, pushing the limits of what current data centers can handle.

The Role of GPUs in AI Workloads

Graphics Processing Units, or GPUs, have become the workhorses for AI. Originally designed for video games, their architecture is perfect for the kind of math AI needs. They can do many calculations at once, which speeds up training and running AI models significantly. This has led to a huge demand for GPUs, sometimes making them hard to get. The impact of AI on electricity usage is also largely tied to these powerful, energy-hungry GPUs.

AI Market Growth Projections

The AI market is exploding. Experts predict it will continue to grow at a rapid pace for years to come. This growth means more companies will need AI infrastructure, leading to even higher demand for computing power. It’s a bit of a cycle: more AI development leads to more demand for hardware, which in turn fuels more AI development. Comparing AI and crypto power demands, AI’s need is becoming more consistent and less volatile than crypto mining’s, which is good for long-term infrastructure planning. Companies like Next Technology are already seeing their stock prices jump because they’re positioned to benefit from this AI boom Next Technology’s stock experienced a significant pre-market surge of 24.14% on September 1, 2025.

Here’s a look at how AI demand is shaping up:

- Training Large Language Models (LLMs): Requires thousands of GPUs running for weeks or months.

- AI Inference: Running AI models to make predictions or generate content also needs significant GPU power, especially at scale.

- Data Preprocessing: Cleaning and preparing the vast datasets used for AI training is a computationally intensive task.

The demand for AI computing is creating a significant strain on existing power grids. Data centers are consuming more electricity than ever before, and this trend is expected to continue as AI adoption spreads across industries. This has led to concerns about energy availability and cost for all users of computing power.

This surge in demand presents both opportunities and challenges for companies that provide computing infrastructure. Adapting to these new needs is key for staying competitive in this fast-moving sector.

Challenges and Risks in AI Integration

So, you’re thinking about getting into AI computing, maybe even using some of that old crypto mining gear? It sounds like a good idea, right? But hold on a sec, it’s not all smooth sailing. There are some pretty big hurdles to jump over.

Infrastructure Costs and Return on Investment

First off, the money. Shifting from crypto mining hardware, which is mostly ASICs, to the GPUs needed for AI is a massive upfront cost. We’re talking serious investment. You really need to crunch the numbers to figure out if the money you’ll make from AI work will actually cover these new expenses and then some. It’s not just about buying the hardware; it’s about the whole setup. You have to ask yourself if the potential long-term earnings are really worth it.

Client Stability and Power Supply Reliability

Then there’s the client side of things. AI projects, especially those from newer companies, can be a bit shaky. They might not have solid funding or a long track record, meaning they could suddenly stop paying or disappear altogether. You need to be careful about who you partner with. On top of that, AI needs a ton of power, all the time.

You’ve got to make sure your power supply is super reliable. Imagine your AI systems going offline because of a local power grid issue; that’s a nightmare scenario. Getting locked into long-term power deals is smart, but you also need to keep an eye on what’s happening with the local electricity grid capacity. We saw xAI run into power problems when setting up a big computer, which shows this is a real issue.

Cooling, Thermal Management, and Regulatory Compliance

These AI chips, like the fancy Nvidia H100s, get incredibly hot. If your cooling systems aren’t top-notch, your expensive equipment could overheat and fail, or just not perform as well as it should. It’s a constant battle to keep things at the right temperature. Plus, there are all sorts of rules and regulations to think about. Depending on where you are and what kind of data you’re handling, you might have to deal with stuff like data privacy laws, how you handle intellectual property, and even rules about energy and water use. It’s a lot to keep track of, and getting it wrong can lead to big problems.

The push into AI computing by former mining operations isn’t just a simple hardware swap; it’s a complex strategic shift. It demands a re-evaluation of financial models, client vetting processes, and operational resilience, particularly concerning energy infrastructure and regulatory landscapes. Successfully integrating AI requires more than just technical know-how; it necessitates robust business planning and risk management.

Here’s a quick look at what miners need to consider:

- Investment: How much capital is needed for GPU clusters versus existing mining rigs?

- Client Due Diligence: Assessing the financial stability and long-term viability of AI clients.

- Power Contracts: Securing consistent and affordable electricity for continuous AI operations.

- Cooling Systems: Implementing advanced thermal management solutions for high-density computing.

- Compliance: Understanding and adhering to data privacy, energy, and environmental regulations.

For example, miners who already use renewable energy sources, like solar or hydro, are in a good spot. They can potentially attract AI clients who are trying to meet their own sustainability goals. It’s a way to make your operation more attractive in a competitive market, especially when you consider the growing focus on sustainable energy solutions.

Energy Consumption: A Shared Concern

It’s pretty clear that both AI and crypto mining are power-hungry beasts. We’re talking about technologies that need serious juice to run, and that’s starting to put a strain on our electrical grids. Think about it: all those powerful computers crunching numbers, solving puzzles, or training complex models – they all need electricity, and a lot of it.

AI’s Impact on Electrical Infrastructure

AI, especially when you’re training those massive models, can use a ton of energy. Some reports suggest that by the end of this decade, data centers supporting AI could be using a significant chunk of the US electricity supply. That’s a big jump from where we are now. It means we need to think about how our power grids can handle this extra load. It’s not just about having enough power, but also about making sure the infrastructure can keep up with the demand, especially as more companies jump into the AI game.

Optimizing Energy Use in Both Sectors

So, what are people doing about it? Well, there’s a lot of work going into making things more efficient. For crypto mining, some are looking at better hardware and trying to use cleaner energy sources. For AI, researchers are tweaking algorithms and designing more efficient chips. It’s a race to get more computing power without burning through as much electricity.

Here’s a quick look at some of the efforts:

- Hardware Efficiency: Developing new chips and processors that do more with less power.

- Algorithm Optimization: Making AI models smaller and faster to train, reducing their computational needs.

- Renewable Energy Sources: Miners and data centers are increasingly looking to solar, wind, and hydro power to reduce their carbon footprint and potentially lower costs.

- Waste Heat Recovery: Some facilities are exploring ways to capture and reuse the heat generated by the equipment.

The push for efficiency isn’t just about being green; it’s also about economics. Cheaper, more sustainable energy means lower operating costs, which is a big deal when you’re running power-intensive operations 24/7.

The Drive Towards Sustainable Energy Solutions

Ultimately, the big picture is about sustainability. Both industries are under pressure to reduce their environmental impact. This means a bigger focus on renewable energy, improving energy efficiency, and finding smarter ways to manage power consumption. It’s a shared challenge, and how we tackle it will shape the future of both AI and crypto mining, and maybe even how we power our digital world.

Navigating Market Competition and Resource Strain

It’s getting pretty crowded out there, isn’t it? As more companies, both old crypto hands and new players, eye the AI gold rush, competition for resources is heating up. This isn’t just about who has the most cash; it’s about who can secure the best power deals, the most reliable infrastructure, and the top talent. Securing long-term contracts with creditworthy clients is becoming the name of the game.

Competition for Power and Infrastructure

Think about it: everyone needs electricity, and a lot of it, for both mining and AI. This puts a strain on local grids and data center capacity. Companies that can lock in stable, affordable power agreements have a serious advantage. It’s not just about having the machines; it’s about keeping them fed with energy without breaking the bank. Plus, finding suitable locations with the right power and cooling capabilities is getting tougher. Some companies are building purely on speculation, which could lead to problems down the line if demand doesn’t keep pace with supply.

Financial and Management Resource Allocation

Shifting gears to AI, or even running both mining and AI operations, requires a massive upfront investment. We’re talking about new hardware, often GPUs which are pricey, and potentially upgrading existing facilities. This isn’t just a capital expenditure issue; it’s also a management challenge. Do you have the right people to manage these new, complex AI workloads? Are your financial resources spread too thin trying to do too much at once? It’s a balancing act, for sure. Some companies are taking on a lot of debt to buy GPUs, which can be risky if the market shifts unexpectedly.

Maintaining a Competitive Edge in Evolving Markets

So, how do you stay ahead? For crypto miners looking at AI, it means understanding the specific needs of AI clients. Reliability is key. AI workloads demand constant uptime, so power supply stability and effective cooling are non-negotiable. Companies that can offer these guarantees, perhaps by partnering with energy providers or investing in robust cooling systems, will stand out. It’s also about being smart with your investments.

Instead of just chasing every trend, some companies are focusing on what they do best, like designing specialized hardware, to stay competitive. Building strong relationships with clients and offering tailored solutions can also make a big difference in this fast-moving landscape. We’re seeing a lot of focus on long-term agreements, some stretching over a decade, to provide that stability.

The pressure to go green is also a factor. Bitcoin miners already using renewable energy sources like solar or hydro are finding themselves attractive to AI clients who need to meet their own sustainability goals. This synergy between clean energy and AI demand could be a significant differentiator for mining operations looking to expand into new markets.

Future Trends in Computing Power

The world of computing power is really changing fast. We’ve got AI needing more and more juice, and crypto mining still chugging along. It’s not just about who has the most powerful machines anymore; it’s about how adaptable and smart companies can be.

Competition or Synergy Between AI and Mining

It feels like AI and crypto mining are often pitted against each other, especially when it comes to grabbing up all the available power. AI models are getting super complex, needing tons of specialized hardware like GPUs. Meanwhile, cryptocurrency mining energy needs are still significant, particularly for major coins like Bitcoin, which rely on ASICs. This competition for resources, especially electricity, is a big deal. We’re seeing power grids stretched thin in some areas, and electricity costs are going up for everyone. It’s a balancing act, for sure.

However, it’s not all a fight. Some companies are finding ways to make both work. They might use their facilities for AI training during off-peak mining times or vice versa. It’s about finding that sweet spot where you can maximize your hardware’s use.

The Future of Digital Infrastructure

What does this mean for data centers? Well, they need to be more flexible. Think about facilities that can easily switch between AI workloads and mining, or even handle both at the same time. This requires smart management of power and cooling. We’re also seeing a push for more efficient hardware, not just for AI but for mining too. Companies that can adapt their infrastructure to meet these changing demands will likely do best. The cost of battery storage, for instance, is dropping, which could help stabilize power for these intensive operations battery storage.

Adaptive Operational Models for Growth

So, how do companies stay ahead? It’s all about being adaptable. Mining companies that are looking at AI aren’t just slapping new servers in; they’re rethinking their whole setup. This might mean:

- Investing in more versatile hardware that can handle different types of tasks.

- Developing hybrid models that allow for dynamic resource allocation.

- Focusing on energy efficiency to keep costs down, no matter the workload.

The drive for more computing power, whether for AI or crypto, is putting a real strain on our electrical systems. Finding sustainable energy solutions and optimizing how we use power will be key for both industries to grow without causing major problems.

Ultimately, the future looks like a mix. Some companies will specialize, while others will try to be masters of both AI and crypto mining. The ones that can manage their resources smartly and adapt quickly are the ones we’ll be hearing about.

The Road Ahead: AI, Mining, and What’s Next

So, where does this leave us? It’s clear that the world of computing power is changing fast. While Bitcoin mining has its ups and downs, the rise of AI is creating a whole new demand for the kind of infrastructure miners already have. Some companies are jumping into AI to find steadier income, while others, like Canaan, are sticking to their roots.

It’s not a simple switch; there are big costs and new challenges, like keeping things cool and making sure the power stays on. Whether miners can successfully balance both AI and crypto, or if one will eventually dominate, is still up in the air. But one thing’s for sure: the companies that can adapt and manage their resources smartly will likely be the ones to watch in this evolving tech landscape.

Frequently Asked Questions

Why are crypto mining companies looking into AI?

Many crypto mining companies are exploring AI because the Bitcoin mining business can be unpredictable. After Bitcoin ‘halving’ events, where the reward for mining new blocks is cut in half, profits can drop. AI offers a more steady income. Plus, miners already have the big, power-hungry buildings and electricity setups that AI also needs.

What’s the main difference between AI computing and crypto mining?

Crypto mining uses special machines called ASICs that do the same math problem over and over to secure a blockchain. AI computing needs different kinds of chips, like GPUs, that are good at handling many different, complex tasks, like understanding images or language. Think of it like needing a calculator for one specific math problem versus needing a powerful computer for lots of different jobs.

Do mining companies need to change their buildings for AI?

Yes, often they do. While miners have lots of power, AI uses a lot of energy and creates a lot of heat from its computer chips. So, mining companies might need to upgrade their cooling systems and make sure their power setup can handle the constant, high demand from AI tasks.

Is it hard for mining companies to start offering AI services?

It can be challenging. They need to spend a lot of money on new equipment and upgrades. They also need to find reliable AI clients who will pay consistently. Plus, there are rules about data privacy and how much energy they use that they have to follow.

Will AI and crypto mining compete for electricity?

Yes, they both use a huge amount of electricity. As more AI data centers are built, they need more power, which can drive up electricity costs for everyone, including crypto miners. Both industries need to find ways to use energy more wisely and look for cleaner energy sources.

Can a company do both AI and crypto mining at the same time?

Some companies are trying to do both, using a ‘hybrid model.’ They might use their facilities for AI when it’s more profitable or when crypto prices are low, and then switch back to mining when that’s more profitable. This helps them make money from different sources and use their equipment in the best way possible.